Why Compliance Matters

Navigating the complex landscape of regulatory compliance is essential for any business. At Securance, we bring extensive knowledge and experience in implementing compliance frameworks across various industries. Our services help ensure your organisation meets all necessary regulatory requirements, safeguarding your business against compliance risks and enhancing operational integrity

Our Compliance Services

Regulatory change and supervision

Regulatory change and supervision has a growing impact on businesses, with active regulators and increasing compliance requirements. The fast-evolving regulatory landscape and the increasing importance of controlled operations, ethical conduct, and transparency fueled by stakeholder demands requires organisations to act effectively. This requires robust compliance programmes: organisations must not only ensure compliance with existing regulations but also proactively anticipate and adapt to new regulatory developments.

Licensing Support

We support organisations in obtaining necessary licenses, whether you are a wealth manager, bank, insurer, or investment firm. Our expertise ensures a smooth and efficient licensing process. We have a proven track record of effectively liaising with supervisory authorities in the context of securing and maintaining the license-to-operate of financial instutions.

Compliance-as-a-Service (CaaS)

Our CaaS offering provides part-time compliance officers to support your compliance department. Ideal for interim needs, we ensure your compliance processes are maintained to the highest standards, combining our in-depth legal and regulatory knowledge with best practices in (IT) governance, risk management, cyber security and (IT) assurance.

Specific regulations and standards

We assist with the implementation and adherence to specific regulations such as NIS2, DORA, WFT, MiFid, AIFMD, GDPR, and the CRA. Many of our clients face a multitude of compliance requirements for various frameworks that often overlap. We have in-depth knowledge of these frameworks and can implement them in an integrated manner, avoiding redundancy and ensuring efficient compliance with market demands. We advise on selecting the appropriate frameworks and provide a comprehensive approach to COSO-ERM, COBIT,DORA, NIS 2, CRA, SOC 1, SOC 2, SOC 3, and ISAE 3402, ensuring your organisation meets all necessary standards without inefficiencies.

Compliance scan

Our compliance scan provides a comprehensive evaluation of your organisation’s adherence to applicable laws and regulations. This in-depth analysis helps identify any gaps and areas for improvement, ensuring your compliance framework is robust and effective.

Step - 1

Analysis of applicable regulation

Our expert analyses all applicable laws and regulations for the client.

Step - 2

Scan of status quo

Our expert assesses the extent to which the client complies.

Step - 3

Defining action plan

Our expert defines the action plan for compliance.

Step - 4

Implementation

Our expert implements the action plan in accordance with best practices.

Step - 5

Client empowerment

Our expert ensures that the client has the tools to remain compliant in the future.

INTEGRATE RISK MANAGEMENT

USE CASE

ABN AMRO

ASR

Fujitsu

Colt Ltd.

Axians

Planday

Analyses

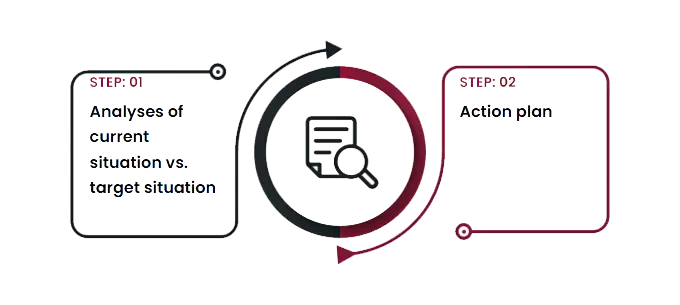

Fit-Gap analyses

Many of our projects begin with a comprehensive gap analysis, which allows us to pinpoint the specific needs of your business. This detailed assessment helps identify existing gaps in your current risk management and compliance practices. Based on these findings, we develop tailored action plans and solutions to address and bridge these gaps effectively. Our goal is to ensure that your organisation operates at peak efficiency and meets all regulatory requirements.

Testimonials

What our Clients Say

Working with Securance was a revelation. They succeeded in developing a risk management policy and assessment that not only elevated our professional standards but also truly fit the nature and scale of our organisation.

Laura Wessemius-Chibrac

CEO stichting NAB impact investing

The critical and reflective dialogue with Securance has enabled us to view challenges from different perspectives and find the best solutions. They were willing to act not only as an advisor or executor but truly as an extension of our organisation.

Jean-Paul van Haarlem

Chief Executive Officer ONVZ

Securance professionally guided the implementation process from start to finish. They helped us find the delicate balance between risk management and the feasibility of control measures. In addition to implementing best practices, they placed strong emphasis on gaining support from our workforce and transferring knowledge to our own team.

Richard de Groot

Director of Asset Management ABN AMRO

Our Partners

Securance as your Compliance partner

At Securance, we believe in maintaining robust internal controls and promoting integrity within business operations. Our services are tailored to meet the stringent requirements set by regulatory bodies, ensuring your organisation is always compliant and resilient. As your dedicated implementation partner, we bring deep expertise and a proven track record in successfully managing risk and compliance challenges across various industries.